You have options when it comes to your medical and pharmacy benefits, each with different levels of coverage. When you visit providers within the Anthem (All States) PPO, HDHP or Kaiser (California Only) HMO network, your cost is less. When seeking care outside of the network, you will pay an increased portion of the costs.

Understanding Your Options:

HMO stands for Health Maintenance Organization. Kaiser’s integrated care delivery system offers care and coverage together in one package, under one roof. The HMO requires you to choose a Kaiser Primary Care Physician (PCP) to direct your care, including referrals to in-network specialists, when necessary.

You will pay a copayment (copay) or coinsurance for most services. There is no out-of-network care. If you are traveling outside the Kaiser California network, they offer extended emergency room care through the Cigna Network. Telehealth visits are available to ensure you and your covered dependents have many convenient ways to access care.

PPO stands for Preferred Provider Organization. A PPO plan allows you to seek care in and outside of the Anthem provider network. You do not need a referral and are not required to select a Primary Care Provider (PCP). You or your covered dependents will pay less out of your pocket by obtaining care in the Anthem provider network. You have access to Virtual Visits to access care when, where, and how you need it.

In a HDHP plan, you have access to seek in and outside of the Anthem provider network. Under a HDHP, you will need to first satisfy your deductible, then you will pay a percentage of the cost (coinsurance) until your out-of-pocket maximum is reached after which the plan will pay 100% of the cost of covered services for the remainder of the plan year. For out-of-network claims you will be responsible for the costs over the allowed Anthem charges and balance billed by the provider or facility. You have access to the same Telehealth providers as the PPO.

The Anthem HDHP plan can be paired with an HSA account. An HSA is a type of savings account that lets you set aside money on a pre-tax basis to pay for qualified medical expenses, including dental and vision. By saving money into your account, you reduce your taxable income. Contributions are tax-free, Account growth is tax-free and Withdrawals are tax-free.

New for 2023, Avanath will contribute up to $1,000 for employee and $1,400 for employee + 1 or more to offset your deductible expenses through Act Wise through Anthem. State income taxes may apply to HSA contributions.

Comparing the Options

Before you review your medical plan options, you should understand how they work. Start with these terms:

- Coinsurance: A set percentage you pay of the cost of the care you receive, for example 20%

- Copay: A set dollar amount you pay when you receive health care, for example $35 when you see a specialist

- Deductible: A set amount you must pay out of your pocket before the plan starts paying part of the cost unless a copay applies

- Out-of-pocket maximum: The most you will pay in a calendar year for provider visits, prescriptions, etc., for covered expenses and includes your deductible, copays, and coinsurance. This “safety net” provides peace of mind for those who have a serious condition or illness

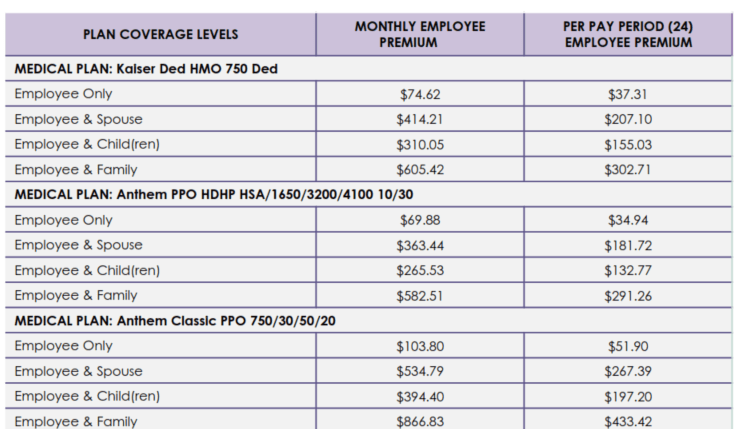

Monthly & Per Pay Period Premiums

Your monthly and per-paycheck contributions are illustrated below based on the plan option and level of coverage you choose.