Avanath offers the following Flexible Spending Account (FSA) plans through a WEX Health Benefits. The Flexible Spending Account plans are available for employees enrolled in the Kaiser HMO, Anthem PPO plan or waiving coverage. Employees enrolling in the High Deductible Health Plan should review details on Health Savings Account (HSA) page.

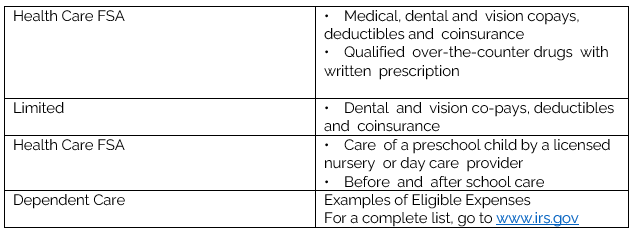

HEALTH CARE FLEXIBLE SPENDING ACCOUNTS (HCFSA)

Employees can contribute funds for health care expenses with pre-tax dollars. However, you must use funds in this account before the end of the plan year (December 31, 2023), or you will forfeit any unused funds not submitted or filed by March 31, 2023, per IRS regulations.

Employees can contribute up to $3,050 for the calendar year (January 1st to December 31, 2023).

LIMITED HEALTH CARE FLEXIBLE SPENDING ACCOUNTS (LHCFSA)

If you are enrolled in the HSA plan and would like additional tax savings, you may also enroll in the Limited Healthcare FSA plan. LHCFSA is limited to reimbursements to qualifying dental and vision expenses, per IRS regulations.

DEPENDENT CARE FLEXIBLE SPENDING ACCOUNTS (DCFSA)

Available to all employees the Dependent Care FSA allows you to contribute tax-free up to $5,000 annually to help pay for eligible expenses towards daycare centers, caregivers or after school programs.

HOW TO USE YOUR ACCOUNT

The FSA debit card allows you to pay for eligible health care expenses at the point of service and deducts the funds directly from your Health Care FSA.

You may use your FSA debit card at locations such as doctor, dentist, pharmacies and vision service providers. The card cannot be used at locations that do not offer services under the plan. Should you attempt to use the card at an ineligible location, the transaction will be denied.

Please remember that if you are using your debit card, you must save your receipts, just in case you are requested to provide a copy for verification or IRS requests.

All expenses for HCFSA, LHCFSA and DCFSA must be incurred during the plan year

- The IRS has a strict “Use-It or Lose-It” rule for FSAs

- Avanath offers the advantage of a rollover feature on your FSA plans, which means if you have remaining funds in your FSA account, you can rollover up to $500 for the 2023 plan year

- You may use your visa card at locations, such as in the doctor’s office, dentist, and pharmacies, but the card cannot be used at locations that do not offer services under the plan

- To review the list of eligible expenses, go to: www.wexinc.com/insights/benefits-toolkit/eligible-expenses

Download the Mobile App for your mobile device.

Search for: Benefits by WEX